:max_bytes(150000):strip_icc()/AppleOperatingRatioExample-5c731357c9e77c000107b603.jpg)

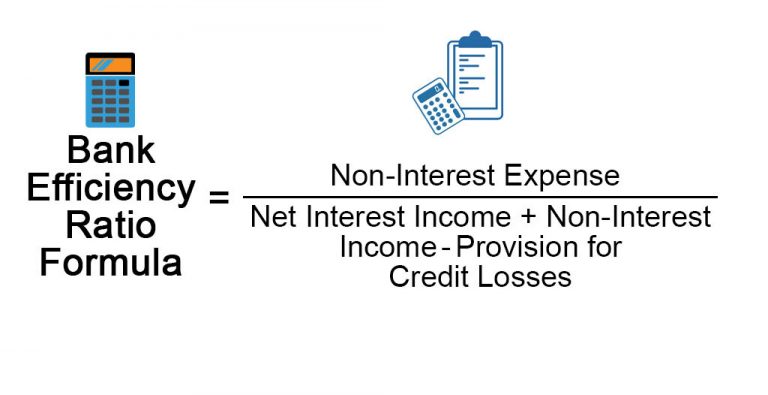

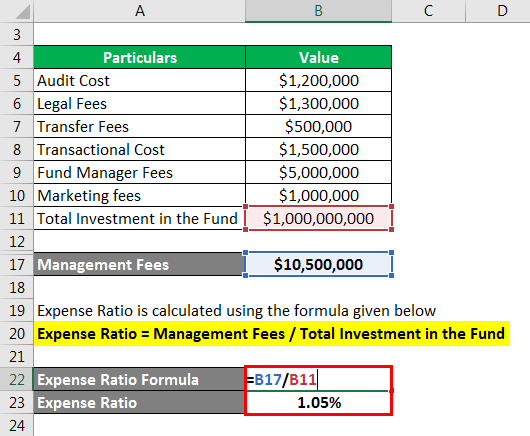

Measures of decline in total renter households from 2016 to 2018 vary widely by Census Bureau survey, ranging from a decrease of 110,000 households in 2018, according to the Housing Vacancy Survey (HVS), to 459,000 from the American Community Survey (ACS) in 2017, the most recent data available. More investor dollars flowed into apartments than any other property sector with total transaction volumes up 9.6 percent year-over-year, according to Real Capital Analytics. Concerns about overbuilding are continually met with reports of record-breaking absorption levels, decreasing vacancy and persistently strong rent growth. As income is generally more sensitive than expenses to changes in interest rates, movement in interest rates will result in a fluctuating efficiency ratio.Following a year of moderate growth and solid fundamentals in 2018, the first six months of 2019 make that past year seem like a lull for the apartment industry. This is because credit unions with lower ratios rely more on loan interest to generate income. In theory, credit unions with higher ratios of fee income to total income should experience less fluctuation in the efficiency ratio. In nonfinancial terms, the efficiency ratio measures how much it costs to create $1 of revenue - the lower the number, the better. Therefore, credit unions generally strive to achieve lower efficiency ratios. Interest Income - Interest Expenses + NIIĪn elevated or increasing efficiency ratio indicates a credit union is losing a larger share of its income to overhead expenses while a lower ratio indicates the credit union is diverting less income into such expenses. The efficiency ratio national average as of year-end 2014 is 75.0%. And when managed successfully, investments in technology can further boost productivity and lower expenses.ĭefinition: The efficiency ratio divides a credit union’s operating expenses by interest income less interest expenses plus non-interest income. Product-pricing strategies have a significant impact on income as such, institutions that price products and services competitively generally have a solid expense to income ratio. Institutions with a full-service strategy and diverse product portfolio will generally have higher expense levels than credit unions with limited offerings.īut the ratio is also a measure of credit union productivity. The operating expense to income national average as of year-end 2014 is 66.4%.Ī credit union’s expense to income ratio depends on its ability to generate income from its products and services. Leaders should compare the operating expense ratio against the operating expense to income ratio, which is subject to larger swings when interest rate changes affect total income.ĭefinition: This metric divides the credit union’s operating expenses by total income. In comparing expenses to assets, this ratio underscores the idea that a larger balance sheet is the result of a larger operation that requires greater resources. The breadth of a credit union's product and service line will also have an impact on this ratio.Įxpense management has a significant impact on a credit union's competiveness and the value it creates for members. The operating expense ratio reflects both the operating efficiency and the operating strategy of a credit union. © Callahan & Associates | Source: Peer-to-Peer Analytics by Callahan & Associates The operating expense ratio national average as of year-end 2014 is 3.12%.įor all U.S. The following selection of benchmarks monitor different areas of a credit union’s health and performance and should be on the quarterly performance reports of all COOs.ĭefinition: This measure divides operating expenses by average total assets. COOs must monitor it all and have an in-depth understanding of not only what is happening but why. Chief operating officers have a finger on the pulse of all areas of the credit union - from revenue to asset growth, and ROA to operating expenses.

0 kommentar(er)

0 kommentar(er)